Regardless of where or how you trade, you are taking a financial risk. But for many day traders, the risky nature of trading is what makes the whole idea enjoyable. It wouldn’t be wrong to say that the life of a day trader is no different to a rollercoaster ride. When it comes to a fast-paced and high-intensity way of life, day trading may be just up your alley. However, before taking up day trading, it’s important to know how to get started and which one of the many day trading strategies out there suits you best. This article provides an overview of some of the most widely practiced day trading strategies.

Before we get started..

In the world of trading, there isn’t an all-inclusive method that works for everyone.

In addition, you should always remember that a strategy that works well for one particular day trader may not work as well for another with the same level of expertise.

While the following day trading strategies are most popular, there is no guarantee that any of these will meet your specific requirements. But you could modify them to meet your specific needs.

a. Trend Trading Strategy

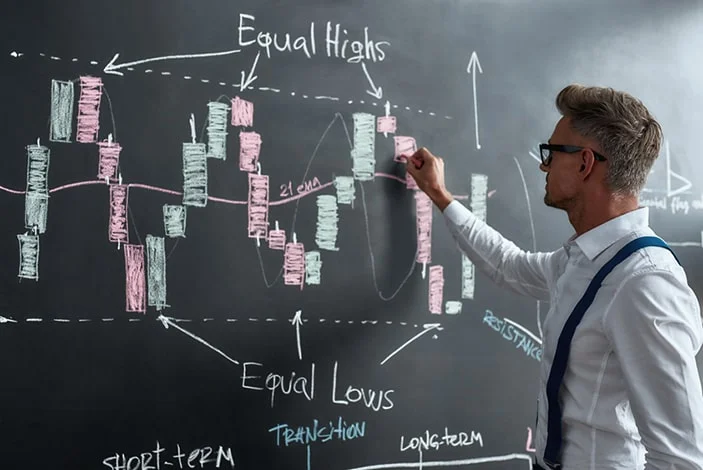

Trend trading is arguably one of the most popular trading strategies, but at the same time, it’s one that requires a flexible mindset. It’s mainly for novices since, as the name implies, it’s based on monitoring market patterns over time utilizing mostly technical analysis.

When using this approach, there is no place for ‘gut feeling’ or having a favorite asset; all that counts is the direction of your candlesticks. Even though it seems counterintuitive, you must adhere to the regulations and keep up with the current trends.

Regular research is the key to optimizing this strategy. Early risers will need to get up at least an hour before market opening to get a sense of the pre-market trend.

Keeping an eye out for any new political, economic, or financial developments is another important strategy since they have the potential to drastically change the direction of a trend. If you want to stay on top of the newest market developments, a free stock trading app with built-in notifications might be a useful resource.

You should evaluate each news update on its own merits and in the context of the relevant market.

[qodef_button size=”medium” type=”” text=”See what strategies are most popular in our community of traders.” custom_class=”” icon_pack=”font_awesome” fa_icon=”” link=”https://app.dev.richtv.io/” target=”_self” color=”” hover_color=”” background_color=”” hover_background_color=”” border_color=”” hover_border_color=”” font_size=”” font_weight=”” margin=””]

b. News Trading Strategy

Trend trading and news trading strategies have certain similarities. But the latter is better suited to turbulent markets and those traders who can respond quickly to developments. For all of these reasons, it is the most widely used day trading strategy in the crypto market today.

Keeping tabs on every media outlet, from print to television to radio to the Internet, is a major part of this strategy. To avoid losing money or increasing profits, it is critical to acquire a “heads-up” from an unofficial source, considering that news nowadays takes seconds to spread like wildfire.

We don’t advocate that everyone uses this strategy to the point where they respond to a rumor before an official statement has even been made, but experienced day traders who have spent a lot of time trading to know what to believe and what not to may use this strategy to their advantage.

[qodef_button size=”medium” type=”” text=”Follow stock & crypto market updates by joining Rich Picks Daily” custom_class=”” icon_pack=”font_awesome” fa_icon=”” link=”https://app.dev.richtv.io/register” target=”_self” color=”” hover_color=”” background_color=”” hover_background_color=”” border_color=”” hover_border_color=”” font_size=”” font_weight=”” margin=””]

c. Start of the Day Trading Strategy

After the markets open, traders use pre-market research and similarities to make judgments based on the current market conditions. If Netflix recently announced another membership price increase, it’s probably not the best moment to invest in Netflix stock.

Even if it’s a matter of opinion, traders like this approach since it requires less maintenance time than others. As a day trader, you need to continually keep an eye on your positions throughout the day. This implies that there are risks.

Risk management orders such as stop-loss and take-profit must be used correctly in order to get the most of your trading experience. A thorough understanding of technical analysis and current market sentiment is an essential need.

[qodef_button size=”medium” type=”” text=”View daily market data before market opening, closing, or any other time of the day.” custom_class=”” icon_pack=”font_awesome” fa_icon=”” link=”https://app.dev.richtv.io/” target=”_self” color=”” hover_color=”” background_color=”” hover_background_color=”” border_color=”” hover_border_color=”” font_size=”” font_weight=”” margin=””]

Conclusion:

The day trading strategies we’ve discussed here are simply a sampling of the many, many viable options available to you as a potential trader. It all comes down to personal preference when it comes to choosing a day trading strategy. Whatever you choose to do with your day trading is a decision that only you can make based on the time you have available, your particular interests, and the goals you expect to attain in the long run.

We hope you found this article useful. If you want to explore different day trading strategies at length, join our community for free by clicking here. And don’t forget to follow our Youtube channel to view useful trading videos. Thanks for reading.

Disclaimer:

Rich Picks Daily company profiles and other investor relations materials, publications, or presentations, including web content, are based on data obtained from sources we believe to be reliable. However, they are not guaranteed to be accurate and are not purported to be complete. You should not construe this information as advice designed to meet the particular investment needs of any investor. Any opinions expressed on this site Rich Picks Daily are subject to change. Rich Picks Daily & RICH TV LIVE and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

Investing is inherently risky. Rich Picks Daily is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission (“SEC”) at www.sec.gov/Canadian CSA https://www.securities-administrators….

By:

By: