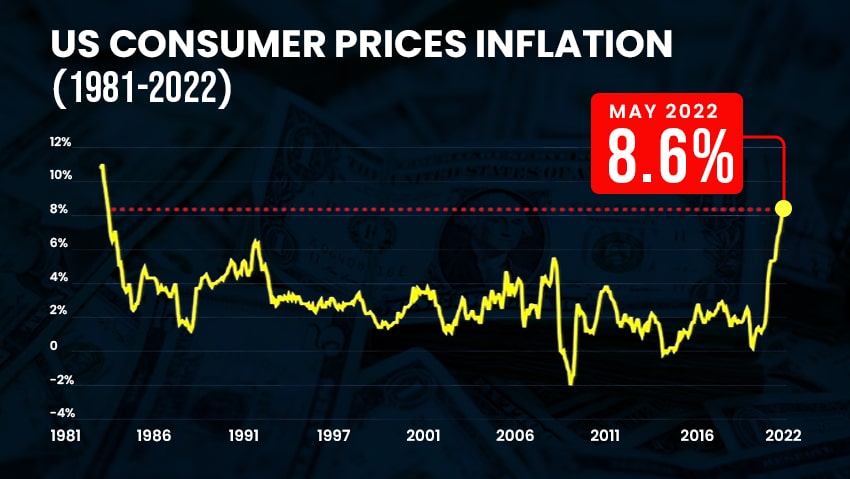

According to US CPI data released on June 10, inflation in the United States accelerated further in May, with prices rising 8.6 percent from a year ago, the fastest increase since December 1981. The US CPI (Consumer Price Index), a broad measure of prices for both goods and services, rose by more than the Dow Jones forecast of 8.3 percent. Core CPI, which excludes volatile food and energy prices, rose by 6%, slightly more than the 5.9 percent forecast.

Over the course of the month of May, the headline CPI rose by 1%, while the core CPI rose by 0.6%, compared to expectations of 0.7 and 0.5% respectively.

In addition to rising food and gas prices, rising housing costs were also a contributing factor.

According to May CPI data, energy prices rose 3.9 percent from a month ago, bringing the year-over-year gain to 34.6 percent. Fuel oil’s monthly gain of 16.9 percent pushed the year-over-year surge to 106.7 percent.

About a third of the US CPI is made up of shelter costs, which rose 0.6% for the month, and this was the fastest one-month increase since March 2004. Annual growth of 5.5% is the highest since February 1991.

Food prices rose by 1.2 percent in May, taking the year-over-year increase to 10.1 percent.

In light of the rising costs, employees were forced to take another cut in pay during May. While hourly earnings rose 0.3% in April, real wages fell 0.6% when inflation was taken into account, according to a separate BLS report. During the past year, real average hourly earnings decreased by 3%.

As a result of the report, stock futures point to a lower opening on Wall Street and an increase in government bond yields.

The month-over-month increases in airfares were 12.6%, used cars and trucks were 1.8%, and dairy products were 2.9%. For the past three months, car prices had been falling, making them a bellwether for inflation. The recent rise in used car prices, however, is concerning because it represents an increase of 16.1% over the previous year. In May, the cost of a brand-new car increased by 1%.

As a result of June 10’s CPI Report, it appears that the US economy is on the verge of a recession and that inflation has not yet peaked.

To date the Fed has raised interest rates by 75 basis points and is widely expected to do so again this year and possibly into 2023. According to CME Group estimates, the central bank’s benchmark short-term borrowing rate currently stands at 0.75 to 1 percent and is expected to rise to 2.75 to 3 percent by the end of the year.

White House and President Biden have been bothered by the issue of inflation.

Supply chain issues related to the COVID pandemic, imbalances created by excessive demand for goods over services, and the Russian attack on Ukraine are cited by administration officials as the primary causes of the surge.

Earlier this week, Biden said that he intends to continue pushing for better supply chains and reducing the budget deficit.

Treasury Secretary Janet Yellen and President Biden have both pointed out that the Federal Reserve is largely responsible for lowering inflation. The administration has largely denied that the billions of dollars spent on COVID aid played a significant role.

To what extent the Fed will have to raise rates is still an open question. Former Treasury Secretary Larry Summers and a team of other economists recently released a white paper that suggests the Federal Reserve will need to go further than many are anticipating. According to the paper, the current inflation situation is more similar to that of the 1980s than it appears because of differences in the methods used to calculate US CPI then and now.

Following the CPI report, stocks in the United States dropped precipitously. The Dow Jones Industrial Average was down 2.3 percent, or about 750 points, at the close of trading. NASDAQ Composite and S&P 500 both fell 3.2% and 2.6%, respectively, as technology shares followed banks and consumer goods down the slide.

To find more details regarding US CPI, including additional articles related to the CPI report, and how the Consumer Price Index for May will impact markets, visit dev.richtv.io. And don’t forget to follow our Youtube channel to view useful investing videos.

Disclaimer

RICH TV LIVE INC. company profiles and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RICH TV LIVE reports company profiles or other investor relations materials and presentations are subject to change. RICH TV LIVE and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

Investing is inherently risky. RICH TV LIVE is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission (“SEC”) at www.sec.gov/Canadian CSA https://www.securities-administrators….

By:

By: