There’s no problem viewing Manulife (TSX:MFC)(NYSE:MFC) as a passive-income dividend stock. Thanks to a roughly 6.5% price appreciation and juicy dividend, the TSX stock’s total return in 2021 was 11.6%, which beat the long-term average market returns but underperformed peer Sun Life’s (TSX:SLF)(NYSE:SLF) total return of almost 28.9% and the market’s total return of 28% in the period.

Why did Manulife stock underperform?

Why did Manulife stock underperform the market and Sun Life? This analyst shared his theory last month:

“Manulife is potentially undervalued because of its China exposure. The Chinese stock market has been one of the worst-performing asset classes this year, which is surprising given they have no COVID cases according to the official statistics and given they’re doing so much better than the rest of the world. Historically, it’s a very good way to play rising interest rates because their future liabilities are discounted based on current interest rates. And if current interest rates are very low, the present value of those future liabilities is actually quite high. But as rates rise, those future liabilities decline in present value.”

Brendan Caldwell, president and CEO, Caldwell Investment Management

Manulife appears to persistently trade at a discount to Sun Life. It’s true that it looks cheap now, trading at about 7.7 times its blended earnings. However, when the market or the life and health insurance industry sell off, MFC stock would trade at an even cheaper multiple. For example, during the pandemic market crash in March 2020, it traded at a blended price-to-earnings ratio of about 5.4 versus SLF stock’s multiple of almost seven.

In 2020, Manulife’s earnings were also impacted with adjusted earnings per share (EPS) falling about 7%. Sun Life was able to increase its adjusted EPS by 6%.

Should you buy Manulife or go with Sun Life instead?

Brian Acker, president, CEO, and chief investment strategist of Acker Finley sides with Sun Life. He commented that Sun Life seems to be a functioning stock with approximately 11% upside over the near term. However, Manulife stock has been the same price for the last 15 years. He was being kind to Manulife. The actual result was worse.

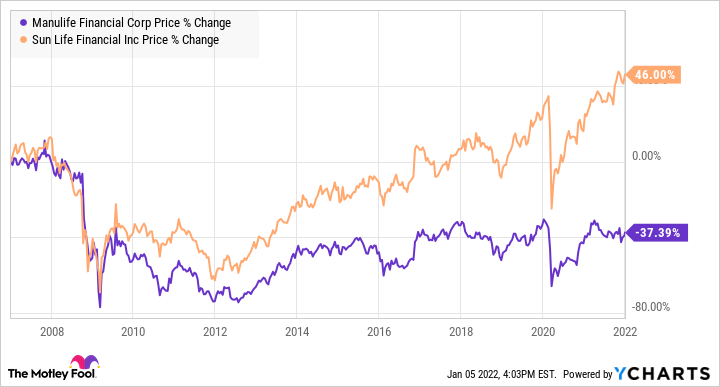

Here’s the 15-year stock price chart comparison between Manulife and Sun Life.

MFC data by YCharts

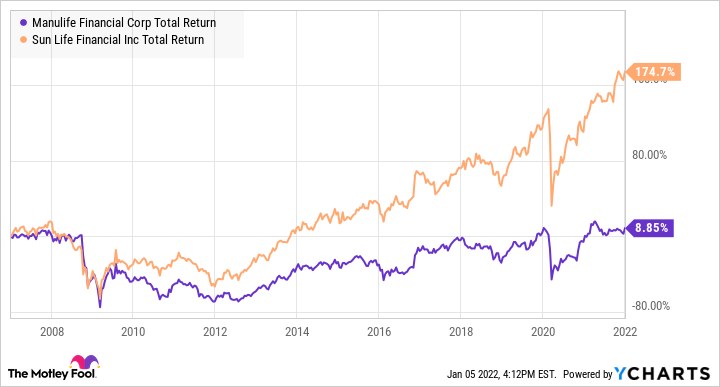

What happens when we account for dividends as well? Manulife’s returns came out positive but were still way below Sun Life’s returns.

MFC Total Return Level data by YCharts

Sun Life’s diversified business appears to be more superior, proven by its more persistent price appreciation for the long haul. Its key earnings are approximately diversified as follows: 32% in asset management, 25% in individual insurance, 21% in group insurance. Geographically, it earns only about 16% of its net income from Asia, 31% in Canada, 16% in the U.S., and 5% in the U.K.

Its asset management net income is earned across North America, Europe, Asia, and Australia. In comparison, Manulife has greater exposure to Asia, which contributes about a third of its core earnings.

If you prioritize income over total returns, Manulife could be a good candidate for a yield of close to 5.3% today. But for total-return investors, it could be a smarter move to build a long-term position in Sun Life shares over time instead.

The post Why Manulife Stock Returned 11.6% in 2021 appeared first on The Motley Fool Canada.

Should you invest $1,000 in Manulife Financial Corporation right now?

Before you consider Manulife Financial Corporation, you may want to hear this.

Motley Fool Canadian Chief Investment Advisor, Iain Butler, and his Stock Advisor Canada team just revealed what they believe are the 10 best stocks for investors to buy right now… and Manulife Financial Corporation wasn’t one of them.

The online investing service they’ve run since 2013, Motley Fool Stock Advisor Canada, has beaten the stock market by over 3X. And right now, they think there are 10 stocks that are better buys.

More reading

- Manulife’s Strategic Moves Make it a Top Buy Right Now

- 3 Stocks to Ride the Current Recovery Wave

- Passive Income: 2 High-Yield Stocks to Watch Out for in 2022

- 2 Top Canadian Stocks for RRSP Investors in 2022

- 2 Top High-Yield Dividend Stocks to Buy Now for a Self-Directed RRSP

The Motley Fool has no position in any of the stocks mentioned. Fool contributor Kay Ng owns shares of Manulife.

By:

By: