Founded in 1984, Aritzia (TSX:ATZ) is a luxury brand that designs and sells apparel and accessories for women in North America. It had its initial public offering in October 2016 at $16 per share.

What happened?

Aritzia just reported its third-quarter (Q3) fiscal 2022 financial results on Wednesday. And the high-growth retailer reacted by sustaining gains of 18.9% on Thursday. It continued to gain strength from the second-quarter results for which the stock reacted for a pop of about 17%.

Its performance achieved on a year-over-year comparison is nothing to sneeze at. For Q3, it highlighted the following:

- Net revenue increased by 63% to $453.3 million

- e-commerce revenue increased by 47% to $148.0 million, making up almost a third of the quarter’s revenue

- Adjusted EBITDA doubled to $109.3 million

- Net income increased by 113% to $64.9 million

- Adjusted net income per share more than doubled to $0.61 from $0.29 in Q3 2021

So what?

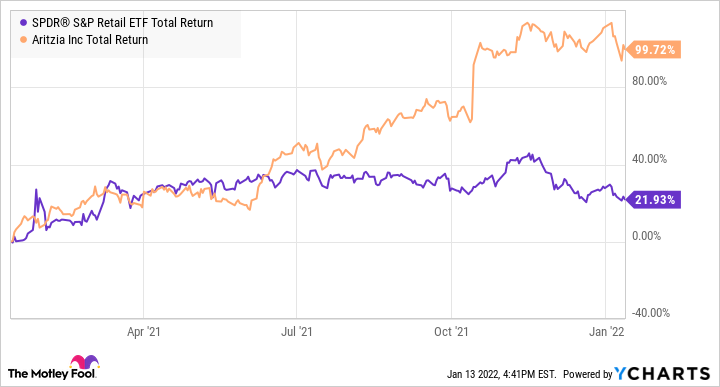

Aritzia is easily among the best-performing retailers in North America. It has greatly exceeded the performance of the benchmark in the last year.

ATZ and XRT Total Return Level data by YCharts

Here’s what Brian Hill, Founder, chief executive officer, and chairman had to say in the recent press release,

“Our strong performance has continued in the fourth quarter to date, despite the recent resurgence of COVID-19, associated supply chain and labour headwinds. As I reflect on our brand acceleration, new client acquisition and the performance of our business in the United States, I see extraordinary opportunities for Aritzia. Our business has never been stronger or better positioned for growth, as we continue to drive digital innovation of our eCommerce channel and Omni capabilities, accelerate boutique growth, expand our product assortment, and acquire new clients, all while continuing to strategically invest in our infrastructure and growing our team of world-class talent.”

Now what?

The company still sees lots of room for expansion in North America. Though, investors need to be careful as the retailer’s multiple has expanded substantially from its rally in the last year. Specifically, it’s north of 33 times earnings on a forward basis! That said, if Aritzia can sustain its growth, it would be able to grind higher.

The post Why Did Aritzia Stock Soar 19% Yesterday? appeared first on The Motley Fool Canada.

Should you invest $1,000 in Well Health right now?

Before you consider Well Health, you may want to hear this.

Motley Fool Canadian Chief Investment Advisor, Iain Butler, and his Stock Advisor Canada team just revealed what they believe are the 10 best stocks for investors to buy right now… and Well Health wasn’t one of them.

The online investing service they’ve run since 2013, Motley Fool Stock Advisor Canada, has beaten the stock market by over 3X. And right now, they think there are 10 stocks that are better buys.

More reading

- 3 High-Growth Retailer Stocks for 2022

- TSX Today: What to Watch for in Stocks on Friday, January 14

- Why Aritzia Stock Is up 18.3%

- TSX Today: What to Watch for in Stocks on Thursday, January 13

- Why I’m Watching This Top Canadian Growth Stock Today

The Motley Fool has no position in any of the stocks mentioned. Fool contributor Kay Ng has no position in any of the stocks mentioned.

By:

By: