The NASDAQ 100 is a famous stock market index that tracks the largest 100 companies listed on the NASDAQ exchange.

Currently, it is seen as a barometer for U.S. large-cap growth stock performance, with a heavy weighting allocated to top tech stocks such as Apple, Microsoft, Advanced Micro Devices, NVIDIA, Alphabet, and Tesla.

Although faltering recently amid rising inflation and the threat of interest rate hikes, the NASDAQ 100 has outperformed substantially in the last decade, going on an incredible bull run after recovering from the aftermath of the 2008 Great Financial Crisis.

Thanks to the proliferation of exchange-traded funds (ETFs), Canadian investors have easy means of gaining exposure to the NASDAQ 100. Today I’ll be reviewing three different ETFs that track it, each with their own pros and cons.

The Canadian hedged version

Up first is iShares NASDAQ 100 Index ETF (TSX:XQQ). With over $1.9 billion AUM, this ETF is the largest of its kind in Canada. Currently, holding this ETF will cost you a 0.39% management expense ratio (MER), which is pricey for a passively managed fund, but not more so than other Canadian competitors.

Unlike other CAD denominated ETFs that track U.S. equity indexes, XQQ is currency hedged. Theoretically, this means that XQQ’s value will not be affected by fluctuations between the CAD-USD pair. In practice, the imperfect way the currency futures contracts are rolled forwards introduces tracking error, which results in a drag on performance.

The U.S. version

Up next is Invesco QQQ Trust (NYSE:QQQ). With over $135 billion AUM, QQQ is the largest of its kind in the world, and popular among institutional and retail investors alike. Currently, holding this ETF will cost you a 0.20% MER, which is nearly half as expensive as XQQ.

If you are comfortable with using Norbert’s Gambit to convert CAD to USD for cheap, you can save significantly by using a less expensive U.S.-denominated ETF. Moreover, U.S. denominated ETFs do not incur a 15% foreign withholding tax on dividends if held inside an RRSP.

The Foolish takeaway

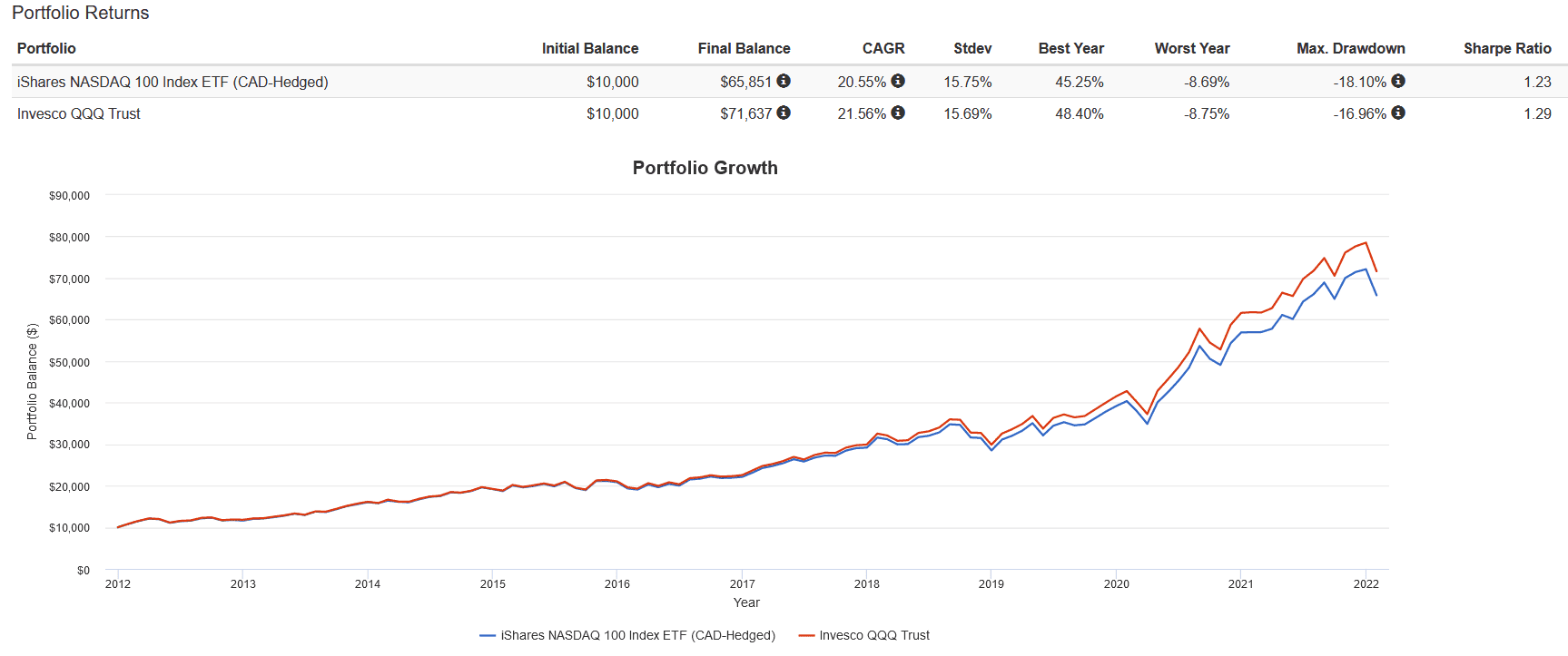

The backtest below shows that although XQQ tracks QQQ closely, it does underperform over time by around 1%. This is due to its higher MER and the cost of the currency hedging. Otherwise, the funds are virtually identical in terms of volatility, drawdowns, and risk-adjusted returns.

Over the long run, currency fluctuations can actually reduce volatility and boost returns. When the USD appreciates against the CAD, unhedged investments will actually get a boost. When this is hedged away, you lose that benefit and incur additional tracking error, causing underperformance over the long term.

My asset allocation advice here is optimize for tax efficiency. If you are investing in a TFSA, XQQ is your best bet as foreign withholding tax applies to all U.S. holdings there anyway. For an RRSP, using Norbert’s Gambit to convert CAD-US cheaply and buying QQQ can help save you on MER and foreign witholding tax.

The post Want to Invest in the NASDAQ as a Canadian? Here Are 2 Ways You Can appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Invesco Qqq Trust?

Before you consider Invesco Qqq Trust, we think you’ll want to hear this.

Our S&P/TSX market doubling* Stock Advisor Canada team just released their top 10 starter stocks for 2022 that we believe could supercharge any portfolio.

Want to see if Invesco Qqq Trust made our list? Get started with Stock Advisor Canada today to receive all 10 of our starter stocks, a fully stocked treasure trove of industry reports, two brand-new stock recommendations every month, and much more.

See the 10 Stocks

* Returns as of 1/18/22

More reading

- 2 ETFs to Double Your Capital in Less Than a Decade

- Canadians: 2 Top ETFs to Buy Right Now!

- 2 Tech ETFs to Buy After the Tech Sell-Off

- A Top Growth ETF to Buy for a February Bounce

- Tech Stock Market Crash: 2 ETFs to Buy Now for Huge Gains

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. Fool contributor Tony Dong has no position in any of the stocks mentioned. The Motley Fool recommends Advanced Micro Devices, Alphabet (A shares), Alphabet (C shares), Apple, Microsoft, Nvidia, and Tesla.

By:

By: