The Bank of Canada (BoC) raised interest rates to 0.50% following the results of its March 2nd policy deliberations. A combination of high inflation (5.1%) and GDP growth (6.75%) meant that the BoC had to pull the trigger on a 0.25% increase.

What does this mean for your portfolio? Well, for one, bond yields will be increasing, which causes their prices to decrease, as the two have an inverse relationship. When it comes to stocks, overvalued, pandemic-era growth and tech sector stocks will likely face strong headwinds moving forwards.

Why we want small bank stocks

However, not all market sectors are affected badly by rising interest rates. Certain ones, like the banking industry, have historically shown improved profitability in a rising interest rate environment. In this situation, banks can charge higher interest rates on their loans, which increases their revenue and profitability.

Everyone loves Canada’s Big Five banks, but I think there could be a case for the smaller banks. Although more volatile and less profitable, these small-cap stocks have better potential for overall growth due to their size. We expect small-cap stocks to be more risky, and therefore we should be compensated for them with better returns over time.

The best candidates for the role

My top two TSX small bank stocks to buy are Canada Western Bank (TSX:CWB) and Laurentian Bank (TSX:LB). Both are smaller bank stocks with market caps of $3.35 billion and $1.86 billion, respectively.

Both banks provide various financial services to personal, business, and institutional customers in Canada and the United States, and operate through three segments: Personal Banking, Commercial Banking, and Capital Markets.

In terms of fundamentals, both CWB and LB have some attractive low valuations, with a forward P/E of 9.58 vs. 8.83, P/B of one vs. 0.74, and P/S of 3.17 vs. 1.93, respectively. Financial ratios are solid, with operating margins of 48% vs. 27% and ROE of 10.48% vs. 2.17% respectively, making CWB better than LB in this case.

Both stocks are more volatile than the market, with a beta of 1.78 vs. 1.19 for CWB vs. LB. LB currently has a higher dividend yield of 3.76% vs. CWB’s yield of 3.15%, but the latter has a much more sustainable payout ratio of 30% vs. the former’s of 155%.

The Foolish takeaway

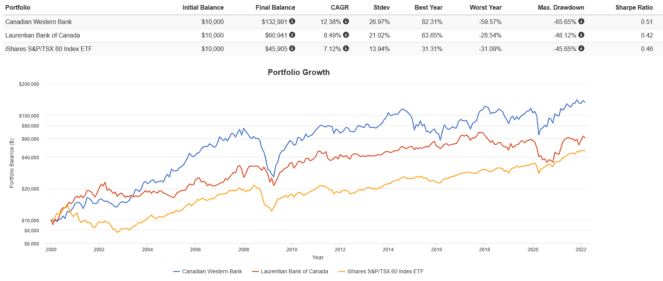

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

That being said, from 2000 to present, with all dividends reinvested, CWB outperformed the S&P/TSX 60 Index, while LB underperformed. The former had better returns, less risk, and lower max drawdowns, whereas the latter had better returns but higher volatility and worse drawdowns.

My pick here with be CWB for its better fundamentals, more sustainable payout ratio, and higher dividend yield. Adding CWB to your portfolio could be an excellent way to diversify away from large-cap, big bank stocks. Over time, the smaller market cap of CWB might create better opportunities for growth and stronger returns.

The post 2 TSX Small Bank Stocks to Buy as Interest Rates Rise appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Cdn Western Bank?

Before you consider Cdn Western Bank, we think you’ll want to hear this.

Our S&P/TSX market doubling Stock Advisor Canada team just released their top 10 starter stocks for 2022 that we believe could be a springboard for any portfolio.

Want to see if Cdn Western Bank made our list? Get started with Stock Advisor Canada today to receive all 10 of our starter stocks, a fully stocked treasure trove of industry reports, two brand-new stock recommendations every month, and much more.

See the 10 Stocks

* Returns as of 1/18/22

More reading

- TSX Rallies 1.7% for its 2nd-Best Day in 2022

- Top 4 Canadian Bank Earnings to Watch This Week

- 3 Top Bank Stocks to Buy Ahead of Earnings

- RRSP Users: 14 Days to Lower Tax Bill in 2022

Fool contributor Tony Dong has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

By:

By: